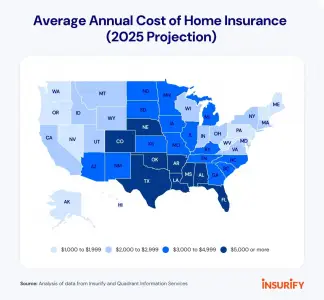

Colorado homeowners scramble for affordable coverage as rates skyrocket

Colorado homeowners feel the pinch as home insurance costs keep climbing According to an Insurify overview premiums will jump by about this year with the average annual premium hitting Colorado s insurance rates are among the the majority expensive in the U S with the state ranking fourth Hail and wildfire risks continue to drive up insurance costs Over Colorado homes are at threat of wildfire damage Rising costs make it increasingly challenging for homeowners to secure affordable coverage According to a ValuePenguin survey In two-thirds of homeowners experienced increased insurance premiums with of their insurers dropping them of homeowners worry about their homes becoming uninsurable find home insurance harder to afford than in previous years and expect rate hikes in shopped for insurance saving an average of annually while saved an average of by asking for discounts reduced their coverage to save money and considered dropping home insurance entirely to self-insure Homeowners without insurance jump Despite the risks illustrated by California s wildfires a LendingTree review shows millions of homeowners remain uninsured Key findings include Nearly one in seven homes in the U S is uninsured totaling million out of million owner-occupied homes Approximately of homes in Colorado are uninsured Home insurance rates in Colorado jumped over the last six years In the average Colorado homeowners insurance program costs per year for of dwelling coverage which is more expensive than the national average of per year Colorado has higher home insurance rates than neighboring states Home insurance is cheaper in Arizona year and Nevada year In Nebraska rates are more expensive at per year Where you live in Colorado also affects home insurance premiums Lamar is the majority of costly with an average annual cost of while the cheapest Fruitvale has an average rate of In Denver home insurance costs annually or above the state average In Colorado Springs the state s second-largest city you ll pay per year on average Colorado works for a fix Colorado is working to lower homeowner insurance costs by adding a program fee That would increase the average annual cost by about but ultimately increase competition enhance homeowner protections and lower premiums The fee would fund state programs to address hail damage and wildfire menace to keep insurance companies from leaving the state Related ArticlesApril Sponsored Colorado home buyers gain more power in March as inventory climbs April Sponsored Shifting dynamics How the pandemic reshaped Denver s housing region April Sponsored As more baby boomers hit the industry senior experts say Find where you re going now April Sponsored Thinking about selling your house The best time to list is coming soon March Sponsored Bobby Berk brings effortless chic to Tri Pointe s Painted Prairie The Colorado legislature is considering two bills to enhance homeowners insurance accessibility House Bill would create two boards that levy a premium fee to fund a reinsurance plan for wildfire losses and a grant campaign for hail-resistant roofs House Bill aims to regulate insurance companies use of exposure assessment models It would require companies to inform customers of their wildfire danger scores and suggest tactics to lower those scores and costs The news and editorial staffs of The Denver Post had no role in this post s preparation